Chattel mortgages for business

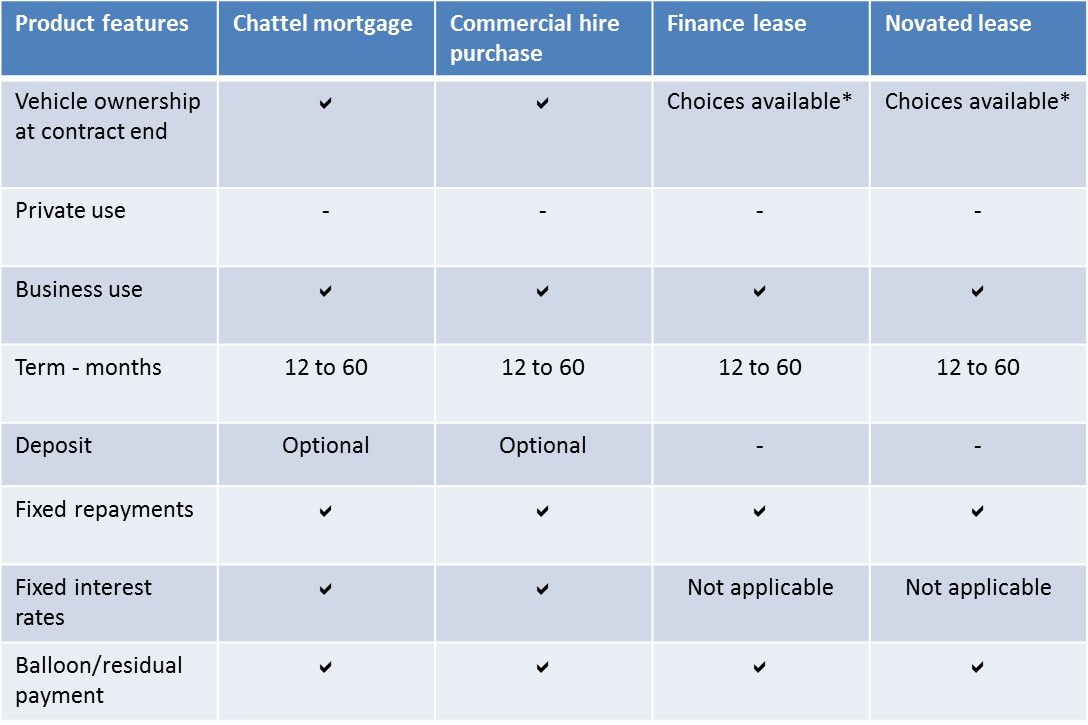

With a Chattel Mortgage you own the vehicle from the date of purchase. We then register our security interest over that vehicle. You own the vehicle from the start of the agreement. If approved, pay no deposit and get 100% finance.

Commercial hire purchase for business

With commercial hire purchase, Subaru Finance owns the vehicle and then we hire it to you. When the final payment is made, full ownership of the vehicle passes to you. This means you have the freedom to use the vehicle while you’re making your instalment payments.

Finance lease for business

With a Finance Lease, Subaru Finance buys the vehicle and leases it to you. You then make regular lease payments to use it. At the end of the lease term you return the vehicle, or we may make you an offer to purchase the vehicle.

Novated lease

A novated lease is available for employees who have the option of salary packaging their leasing rentals. Your employer pays the rental payments to Subaru Finance and you enjoy full use of the motor vehicle.

*Available to ABN holders where the vehicle will be used predominantly for your business (more than 50%).

Finance provided by Macquarie Leasing Pty Limited ABN 38 002 674 982 (Australian Credit Licence No. 394925), subject to its credit assessment criteria. Fees and charges are payable. Full conditions available on application. Subaru Finance is a registered business name of Macquarie Leasing Pty Ltd ABN 38 002 674 982 (Australian Credit Licence 394925) and is used under licence.